360° Project Screening and Appraisal Tool

About

The 360° Project Screening and Appraisal Tool has been developed to support the screening and analytical evaluation of Public-Private Partnership (PPP) projects. Designed to facilitate informed decision-making from the earliest stages of project development, the tool is structured around three critical appraisal phases.

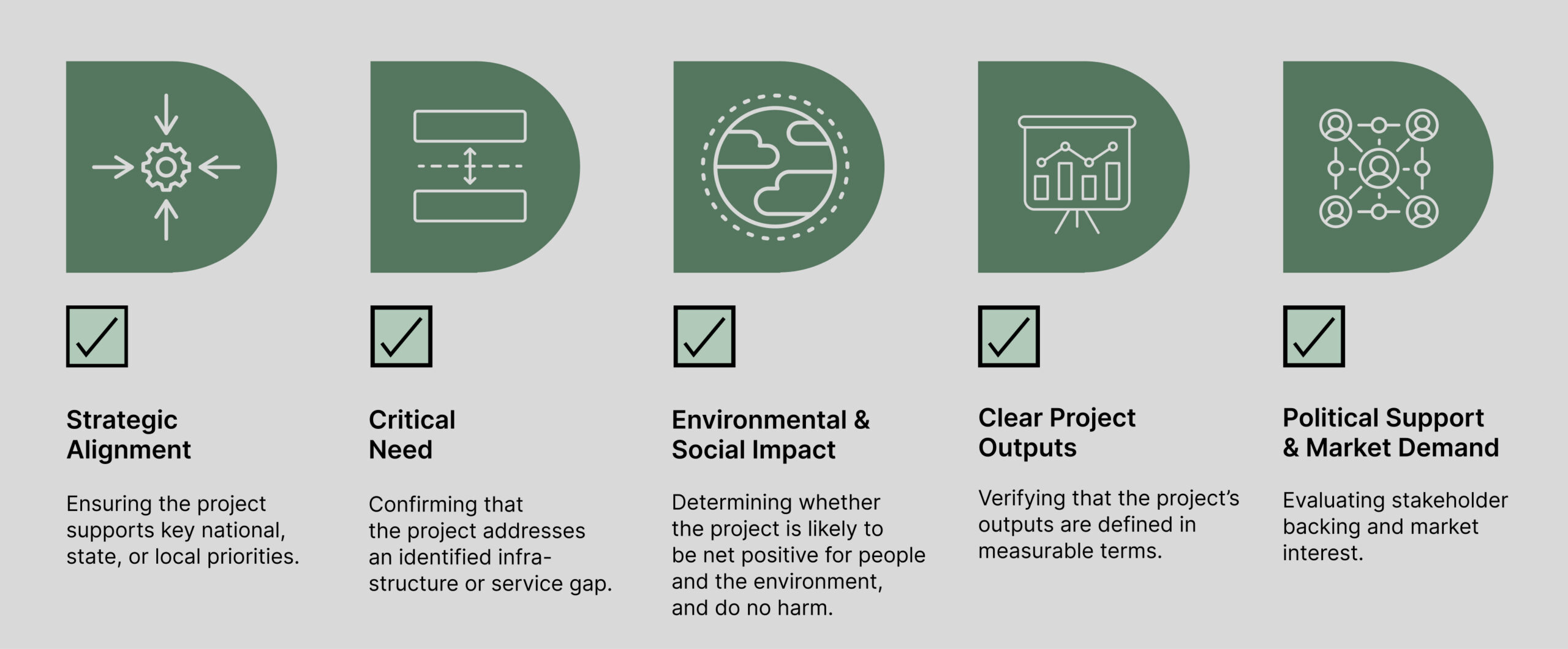

At this initial stage, the tool focuses on rapid, critical screening to determine if a project warrants further assessment. It employs a set of key Yes/No questions that address fundamental criteria such as:

- Strategic Alignment: Ensuring the project supports key national, state, or local priorities.

- Critical Need: Confirming that the project addresses an identified infrastructure or service gap.

- Environmental & Social Impact: Determining whether the project is likely to be net positive for people and the environment, and do no harm.

- Political Support and Market Demand: Evaluating stakeholder backing and market interest.

- Clear Project Outputs: Verifying that the project’s outputs are defined in measurable terms.

This stage provides decision-makers with a swift mechanism to filter out projects that do not meet essential public value criteria.

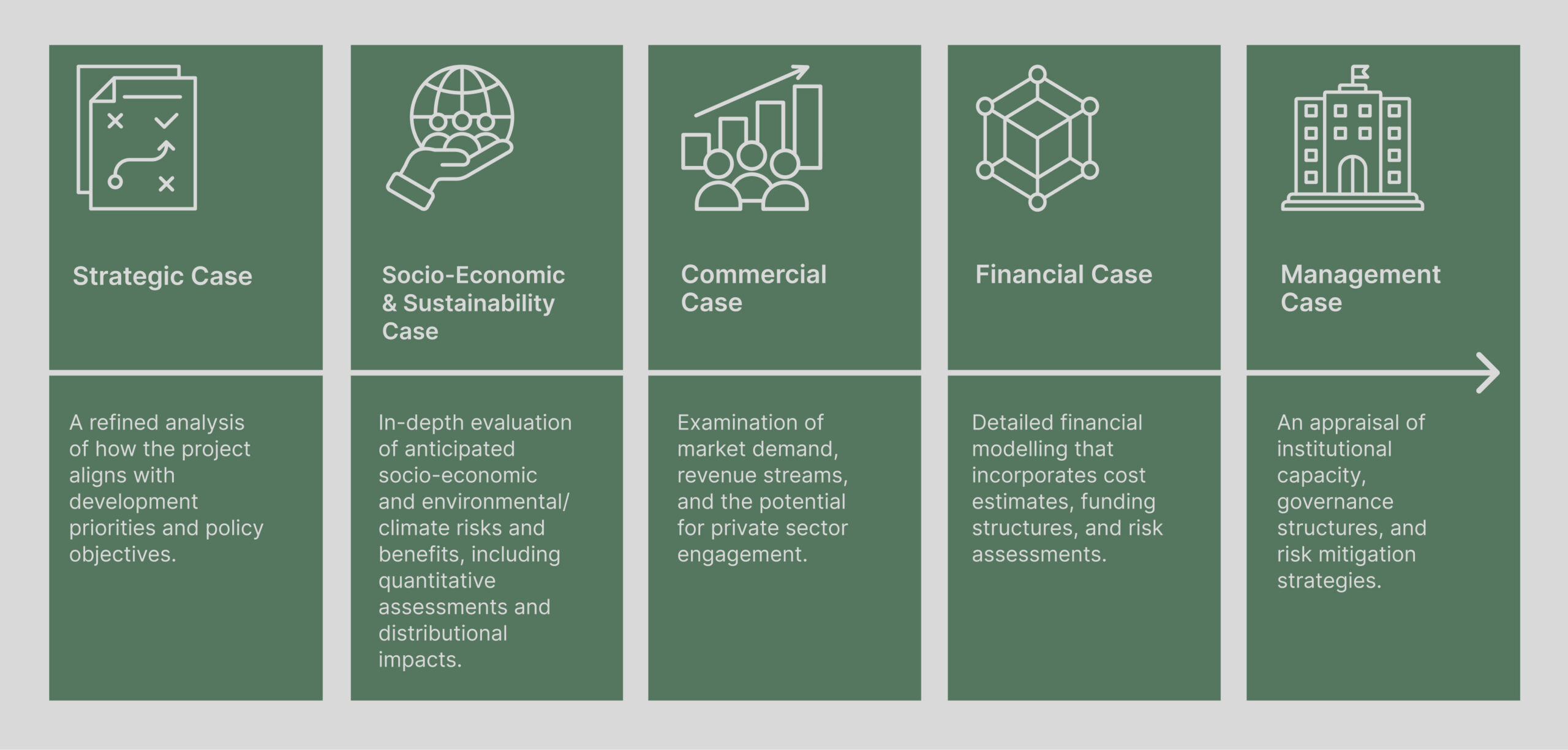

For projects that pass the initial screening, the tool moves into the Concept Note/Pre-Feasibility stage. Here, the assessment is more detailed and is organised around the UK Five Case Model:

- Strategic Case: A refined analysis of how the project aligns with development priorities and policy objectives.

- Socio-Economic and Sustainability Case: In-depth evaluation of anticipated socio-economic and environmental/climate risks and benefits, including quantitative assessments and distributional impacts.

- Commercial Case: Examination of market demand, revenue streams, and the potential for private sector engagement.

- Financial Case: Detailed financial modeling that incorporates cost estimates, funding structures, and risk assessments.

- Management Case: An appraisal of institutional capacity, governance structures, and risk mitigation strategies.

This stage not only confirms the project’s viability but also starts shaping the project preparation process by identifying key areas for further development.

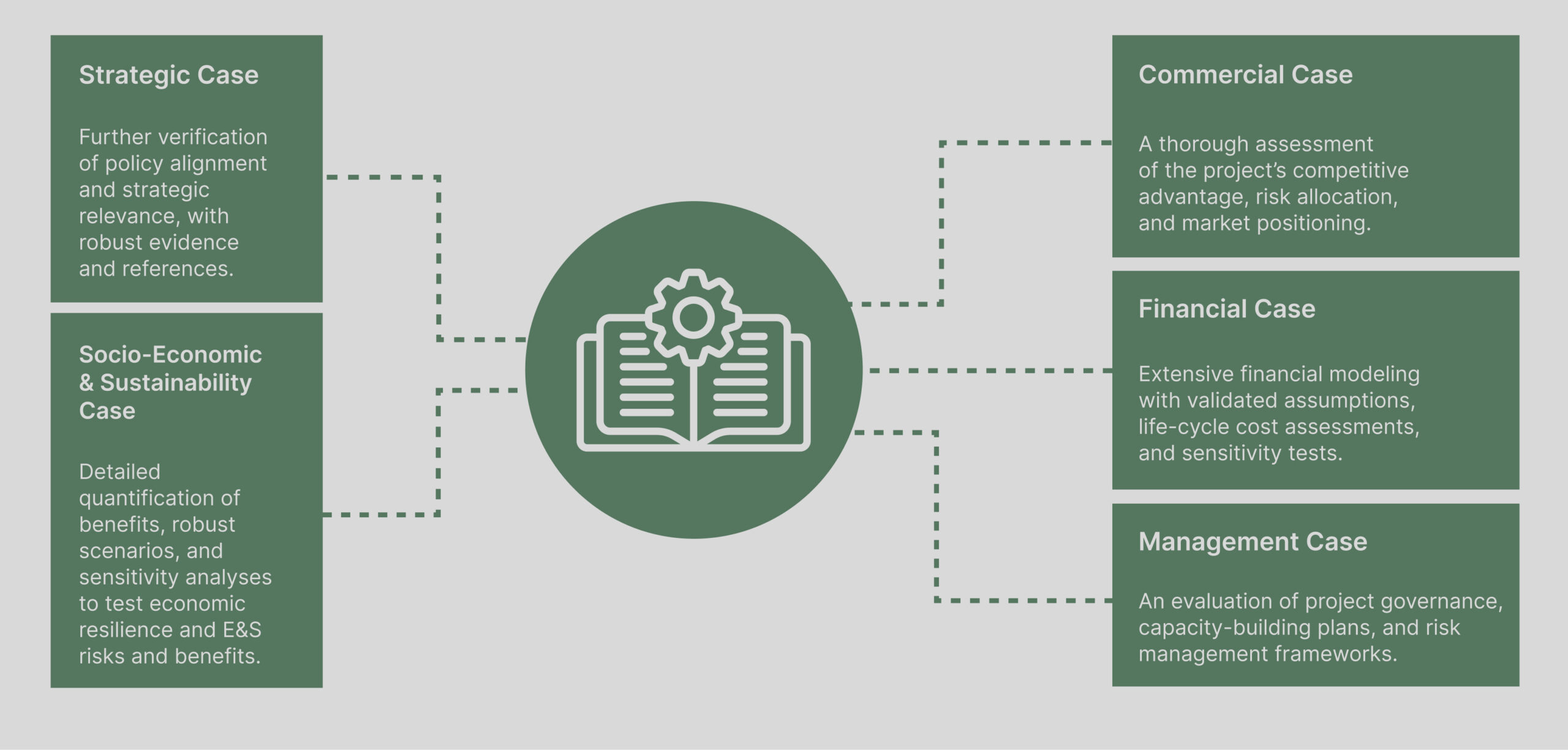

In the final stage, the tool facilitates a comprehensive evaluation through full feasibility studies. The analysis becomes even more granular and is again structured around the UK Five Case Model, with progressive, detailed questions that validate and build upon earlier assessments:

- Strategic Case: Further verification of policy alignment and strategic relevance, with robust evidence and references.

- Socio-Economic and Sustainability Case: Detailed quantification of benefits, robust scenarios, and sensitivity analyses to test economic resilience and E&S risks and benefits.

- Commercial Case: A thorough assessment of the project’s competitive advantage, risk allocation, and market positioning.

- Financial Case: Extensive financial modeling with validated assumptions, lifecycle cost assessments, and sensitivity tests.

- Management Case: An evaluation of project governance, capacity-building plans, and risk management frameworks.

At this stage, the tool transforms into an analytical guide that not only appraises the project’s overall viability but also helps to refine the project preparation, ensuring that all aspects are well-documented and aligned with best practices.

Who is this tool for?

- Federal & Sub National Levels

- PPP Specialists & Project Analysis

- Lenders & Institutional Investors

- Private Sector Partners

- Consultants & Advisory Firms

Government officials and policymakers require a comprehensive evaluation of PPP projects to ensure they align with strategic public objectives and address critical infrastructure or service gaps. While strategic alignment and public value are key, these stakeholders are also interested in the project’s economic, financial, commercial, socio-economic and E&S risk and sustainability and management aspects. The 360° Project Screening and Assessment Tool offers an integrated framework that provides the full spectrum of analysis necessary for informed decision-making.

PPP specialists and project analysts need to assess projects across all evaluation dimensions – from strategic to management – to develop robust and actionable proposals. Although their focus may lean toward operational and financial feasibility, they require a holistic view that encompasses economic viability, commercial attractiveness, and overall governance. The tool facilitates a methodical, multi-dimensional evaluation that supports every stage of project preparation.

Lenders and institutional investors prioritise financial viability and risk management, yet their decision-making also hinges on understanding a project’s strategic fit, economic benefits, E&S risk and sustainability and management capacity. The 360° Project Appraisal Tool delivers a comprehensive analysis that integrates all these aspects, enabling investors to confidently assess a project’s viability and potential for sustainable returns.

Private sector partners are primarily interested in the commercial prospects and financial returns of a project. But they also value insights into the project’s strategic alignment, economic impact, and governance structure. By using the 360° Project Appraisal Tool, private sector stakeholders can review all facets of a project, ensuring it meets investment criteria including E&S risk and sustainability and broader public objectives.

Consultants and advisory professionals require an all-encompassing, evidence-based approach to project appraisal to provide actionable recommendations. Their focus may vary—from strategic and economic considerations to financial structuring and risk management and sustainable investing —but they benefit from a tool that delivers a complete analysis. The 360° Project Screening and Assessment Tool offers a structured, holistic framework that underpins rigorous evaluation and supports the development of robust, data-driven project proposals.

FAQ

What is the 360° PPP Project Screening and Assessment Tool?

The 360° PPP Project Screening and Assessment Tool is a structured, evidence-based framework designed to support the screening, evaluation, and preparation of PPP projects. It applies a three-stage methodology—Project Identification, Concept Note/Pre-Feasibility, and Outline Business Case (OBC)/Full Feasibility—aligned with the UK Five Case Model. It enables decision-makers to assess projects against strategic, socio-economic, commercial, financial, and management dimensions, while integrating environmental, social, climate, and gender considerations.

What is the tool used for?

The tool has dual purposes:

- As a screening mechanism, it helps governments and PPP units quickly assess whether a project should proceed to the next stage of preparation.

- As an analytical guide, it offers a step-by-step framework to support quality project preparation and improve bankability, sustainability, and implementability of PPP projects.

Who can use the tool?

The tool is suitable for use by a wide range of stakeholders:

- Public Sector (federal and subnational MDAs, PPP Units, planning commissions)

- PPP Analysts and Project Preparation Teams

- Private Sector Investors and Developers

- Lenders and DFIs

- Transaction Advisors and Consulting Firms

- Development Partners supporting infrastructure delivery

Do I need to complete each stage sequentially, or can I use the tool flexibly depending on my project’s maturity?

No, you do not need to complete the tool sequentially. The 360° PPP Screening and Assessment Tool is designed to be modular and flexible, allowing users to apply the relevant stage based on the current maturity level of their project. You can start at any stage depending on where your project sits in the lifecycle:

- Stage 1 – Project Identification: A rapid go/no-go filter to screen projects early, using basic qualifying questions.

- Stage 2 – Concept Note / Pre-Feasibility: A structured viability check across the Five Case Model using weighted scoring; useful for refining project concepts and prioritizing those with strong public value.

- Stage 3 – Outline Business Case (OBC) / Full Feasibility: A detailed technical and financial appraisal tool to guide preparation or assess readiness for procurement, based on more rigorous evidence.

Each stage serves a distinct function and can be used independently or in combination depending on project context.

What is the Five Case Model and how is it applied here?

The Five Case Model is a globally accepted framework for project appraisal. It is applied in this tool as follows:

- Strategic Case – Does the project align with policy and address a real need?

- Socio-Economic and Sustainability Case – Does it deliver inclusive development, climate resilience, and environmental benefits?

- Commercial Case – Is it market-attractive and revenue-viable?

- Financial Case – Can it be structured for value for money and fiscal sustainability?

- Management Case – Is there implementation capacity and a sound delivery structure?

Can the tool be used for both solicited and unsolicited PPP proposals?

Yes. The tool is applicable to both solicited PPP projects initiated by the government and unsolicited proposals submitted by the private sector. It ensures consistency in how all projects are screened and evaluated, regardless of origin.

What is the Concept Note Scoring Framework and how does it work?

The Concept Note scoring framework evaluates projects based on the Five Case Model using a weighted score methodology:

- Each Case scores out of 100

- Pass Criteria 1: Minimum 80% in all Cases (70% for Management)

- Pass Criteria 2: Weighted average score ≥ 80%

(Strategic 20%, Socio-Economic 25%, Commercial 20%, Financial 20%, Management 15%)

This ensures a balanced project that scores well across all viability dimensions—not just one.

What is the OBC Scoring Framework and how is it different?

The OBC (Outline Business Case) Scoring Framework is applied at a more advanced project preparation stage and uses:

- Evidence-based scoring on each question: Yes = 2, Partially = 1, No = 0

- Threshold score: ≥80% in each Case (except Management, where ≥70% is acceptable)

- Weighted average score: Must exceed 80% overall

- Greater emphasis is placed on validated evidence from feasibility studies, models, and stakeholder engagement.

Why does the Socio-Economic and Sustainability Case carry the highest weight?

PPP projects, while needing to be bankable, must also deliver inclusive development, gender equality, climate resilience, and poverty reduction. Assigning the highest weight (25%) to this Case ensures that public value, not just commercial value, drives project selection and design.

What happens if a project performs well in one area but poorly in another?

The dual-pass criteria are designed to prevent overcompensation. For instance, a high commercial score cannot mask strategic or environmental weaknesses. Projects must demonstrate balanced strength across all five cases to be recommended for further development or procurement.

Can the tool help improve a project that does not initially pass?

Yes. One of the core benefits of the tool is its use as a project preparation guide. Failed assessments point to specific weaknesses—such as poor market analysis or weak institutional capacity—that can be addressed in subsequent stages through technical assistance or further studies.

Can the tool be customized or adapted for different sectors or states?

Yes. While the tool is structured around global good practices and Nigerian PPP realities, it can be customized for:

- Sector-specific needs (e.g., health, transport, energy)

- Subnational contexts, including states with varying legal frameworks and PPP maturity

- Development partner requirements, such as climate finance alignment or SDG targets

How does the tool integrate climate, gender, and environmental sustainability?

Environmental, Social, and Climate (ESC) considerations are fully embedded in both the Concept Note and OBC scoring frameworks. Projects are assessed for:

- Net positive or harmful environmental effects

- Gender responsiveness and inclusion

- Climate adaptation and mitigation features

- SDG and NDC alignment

Is the tool compatible with Nigeria’s PPP and procurement laws?

Yes. The tool is aligned with Nigeria’s national PPP policy framework, the Public Procurement Act (2007), and relevant subnational PPP laws. It helps ensure compliance with public value, transparency, and fiscal responsibility principles in project selection and development.

Is training required to use the tool effectively?

While the tool is intuitive, effective use—especially at the OBC stage—requires basic PPP knowledge, experience with project finance, and familiarity with public investment processes. Training and technical support can be provided to institutionalize its use.

Where does the tool fit into the broader PPP lifecycle?

The 360° Tool is designed for the early-to-mid stages of the PPP lifecycle:

- Screening at project identification

- Structuring and preparation during pre-feasibility and OBC development

- It ensures that only well-prepared, viable, and sustainable projects move forward to procurement and transaction advisory.

How does the tool support development partners and DFIs?

Development partners can use the tool to:

- Screen projects for funding or technical support

- Assess readiness for climate finance

- Benchmark project quality and risk

- Enhance transparency in PPP pipeline